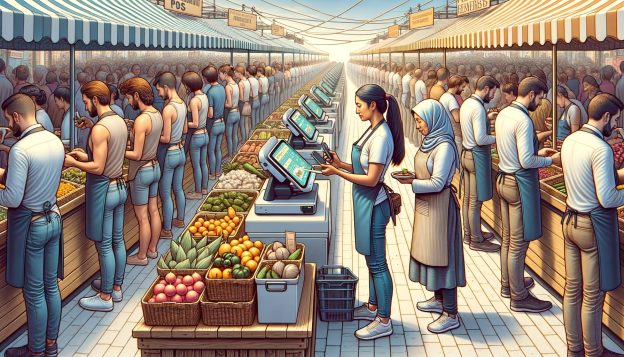

In today’s fast-paced world, mobile vendors play a crucial role in providing convenient and accessible services to customers. Whether it’s food trucks, pop-up shops, or mobile service providers, these vendors rely on efficient and reliable payment systems to ensure smooth transactions. This is where portable POS (Point of Sale) systems come into play. Portable POS systems offer a range of benefits for mobile vendors, allowing them to streamline their operations, enhance customer experience, and ensure data security.

In this comprehensive guide, we will explore the advantages of portable POS systems for mobile vendors, key features to consider when choosing a system, how they enhance efficiency and productivity, their role in inventory management, strategies to enhance customer experience, ensuring data security and compliance, integrating with online platforms, and address common FAQs.

Advantages of Portable POS Systems for Mobile Vendors

- Mobility and Flexibility: One of the primary advantages of portable POS systems is their mobility and flexibility. Mobile vendors can easily move around and accept payments from anywhere, whether it’s a crowded event, a busy street corner, or a customer’s doorstep. This flexibility allows vendors to reach a wider audience and cater to customers’ needs in various locations.

- Increased Sales and Revenue: Portable POS systems enable mobile vendors to accept card payments, which can significantly increase sales and revenue. With the rise of cashless transactions, customers expect the convenience of paying with their cards. By offering this option, mobile vendors can attract more customers and capitalize on impulse purchases.

- Improved Customer Experience: Portable POS systems enhance the overall customer experience by providing a seamless and efficient payment process. Customers no longer have to worry about carrying cash or waiting in long queues. With a portable POS system, vendors can quickly process payments, provide digital receipts, and offer personalized services, leading to higher customer satisfaction and loyalty.

- Real-Time Inventory Management: Portable POS systems offer real-time inventory management capabilities, allowing mobile vendors to track their stock levels accurately. This feature helps vendors avoid stockouts, optimize their inventory, and make informed decisions about restocking. By having a clear view of their inventory, vendors can ensure they have the right products available at all times, reducing the risk of lost sales.

- Streamlined Operations: Portable POS systems streamline various operational tasks for mobile vendors. These systems can handle multiple functions, including inventory management, sales reporting, employee management, and customer relationship management. By consolidating these tasks into a single system, vendors can save time, reduce errors, and focus on delivering excellent products and services.

- Enhanced Data Security: Data security is a significant concern for mobile vendors, especially when handling customer payment information. Portable POS systems offer robust security features, such as encryption and tokenization, to protect sensitive data. These systems comply with industry standards and regulations, ensuring that customer information is secure and reducing the risk of data breaches.

- Integration with Online Platforms: Portable POS systems can be seamlessly integrated with online platforms, such as e-commerce websites and social media channels. This integration allows mobile vendors to expand their reach beyond physical locations and tap into the growing online market. By offering online ordering and payment options, vendors can attract a broader customer base and increase sales.

- Analytics and Reporting: Portable POS systems provide valuable analytics and reporting capabilities, giving mobile vendors insights into their business performance. Vendors can access real-time sales data, track trends, identify top-selling products, and analyze customer behavior. These insights help vendors make data-driven decisions, optimize their operations, and identify opportunities for growth.

- Cost Savings: Portable POS systems can lead to significant cost savings for mobile vendors. By eliminating the need for traditional cash registers and manual record-keeping, vendors can reduce labor costs and minimize human errors. Additionally, portable POS systems often offer competitive pricing models, allowing vendors to choose a plan that suits their budget and business needs.

- Scalability and Growth: As mobile vendors expand their operations, scalability becomes crucial. Portable POS systems offer scalability, allowing vendors to add more devices, users, and locations as their business grows. This flexibility ensures that the POS system can adapt to changing business requirements and support future expansion plans.

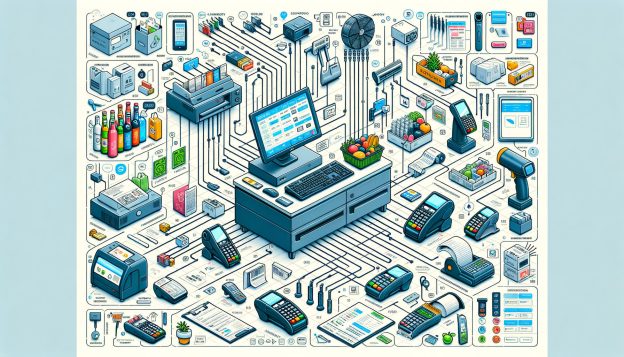

Key Features to Consider When Choosing a Portable POS System

When selecting a portable POS system, mobile vendors should consider several key features to ensure they choose the right solution for their business. These features include:

- Mobility and Connectivity: The system should be lightweight, portable, and have reliable connectivity options, such as Wi-Fi, 4G, or Bluetooth. This ensures that vendors can accept payments and access the system’s features regardless of their location.

- Payment Options: The POS system should support a wide range of payment methods, including credit cards, debit cards, mobile wallets, and contactless payments. This ensures that vendors can cater to customers’ preferred payment methods and offer a seamless checkout experience.

- Inventory Management: The system should have robust inventory management capabilities, allowing vendors to track stock levels, manage product variations, set reorder points, and generate reports. This feature helps vendors optimize their inventory, avoid stockouts, and make data-driven decisions.

- Sales Reporting and Analytics: The POS system should provide comprehensive sales reporting and analytics features. Vendors should be able to access real-time sales data, track performance metrics, and generate customized reports. This information helps vendors gain insights into their business and make informed decisions.

- Customer Relationship Management (CRM): A portable POS system with CRM capabilities enables vendors to store customer information, track purchase history, and offer personalized services. This feature helps vendors build strong customer relationships, provide targeted promotions, and enhance the overall customer experience.

- Integration with Third-Party Apps: The POS system should have the ability to integrate with other business tools and apps, such as accounting software, loyalty programs, and online ordering platforms. This integration streamlines operations, eliminates manual data entry, and enhances efficiency.

- User-Friendly Interface: The system should have an intuitive and user-friendly interface that is easy to navigate and requires minimal training. This ensures that vendors can quickly adapt to the system and perform tasks efficiently, even in fast-paced environments.

- Security and Compliance: Data security is crucial for mobile vendors. The POS system should have robust security features, such as encryption, tokenization, and compliance with industry standards, such as PCI DSS. Vendors should also consider the system’s data backup and recovery capabilities to ensure business continuity.

- Customer Support: Reliable customer support is essential when using a portable POS system. Vendors should choose a provider that offers 24/7 technical support, regular software updates, and training resources. This ensures that vendors can quickly resolve any issues and maximize the system’s potential.

- Pricing and Scalability: Vendors should consider the pricing structure and scalability options offered by the POS system provider. It’s important to choose a system that aligns with the business’s budget and growth plans. Vendors should also evaluate any additional fees, such as transaction fees or hardware costs, to make an informed decision.

How Portable POS Systems Enhance Efficiency and Productivity for Mobile Vendors

Portable POS systems offer several features and functionalities that enhance efficiency and productivity for mobile vendors. Let’s explore how these systems contribute to streamlining operations and improving overall productivity.

- Quick and Easy Transactions: Portable POS systems enable mobile vendors to process transactions quickly and efficiently. With a few taps on a mobile device or a connected card reader, vendors can accept payments, generate digital receipts, and complete the transaction in seconds. This eliminates the need for manual calculations, reduces human errors, and speeds up the checkout process.

- Inventory Management: Portable POS systems provide real-time inventory management capabilities, allowing vendors to track stock levels, manage product variations, and set reorder points. Vendors can easily update their inventory as sales are made, ensuring accurate stock information at all times. This feature helps vendors avoid stockouts, optimize their inventory, and make informed decisions about restocking.

- Employee Management: Portable POS systems often include employee management features, such as time tracking, shift scheduling, and performance monitoring. Vendors can easily assign tasks, track employee hours, and generate reports. This streamlines employee management processes, reduces administrative tasks, and improves overall productivity.

- Sales Reporting and Analytics: Portable POS systems provide comprehensive sales reporting and analytics features. Vendors can access real-time sales data, track performance metrics, and generate customized reports. This information helps vendors identify top-selling products, track trends, and make data-driven decisions. By analyzing sales data, vendors can optimize their product offerings, adjust pricing strategies, and identify opportunities for growth.

- Customer Relationship Management (CRM): Portable POS systems with CRM capabilities enable vendors to store customer information, track purchase history, and offer personalized services. Vendors can easily access customer profiles, view past purchases, and provide tailored recommendations. This feature helps vendors build strong customer relationships, provide targeted promotions, and enhance the overall customer experience.

- Streamlined Accounting: Portable POS systems often integrate with accounting software, automating the process of recording sales and expenses. This integration eliminates the need for manual data entry, reduces the risk of errors, and saves time. Vendors can generate accurate financial reports, reconcile transactions, and streamline their accounting processes.

- Offline Mode: Portable POS systems often have an offline mode feature, allowing vendors to continue accepting payments even when there is no internet connection. The system securely stores transaction data and syncs it with the server once the connection is restored. This feature ensures that vendors can continue operating without interruptions, even in areas with poor connectivity.

- Customization and Scalability: Portable POS systems offer customization options, allowing vendors to tailor the system to their specific business needs. Vendors can customize the user interface, add or remove features, and create personalized reports. Additionally, these systems are scalable, allowing vendors to add more devices, users, and locations as their business grows. This flexibility ensures that the POS system can adapt to changing business requirements and support future expansion plans.

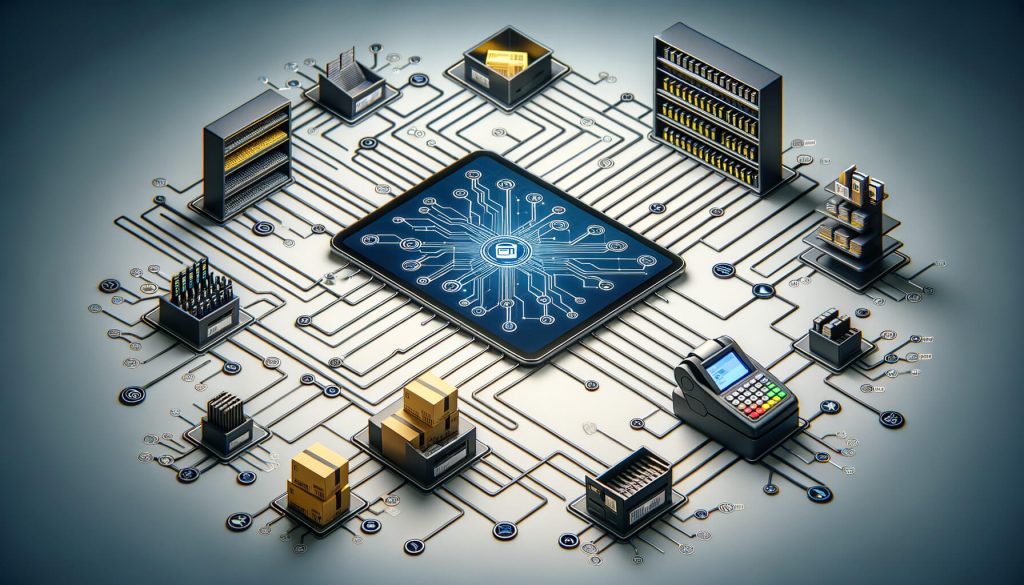

The Role of Portable POS Systems in Streamlining Inventory Management for Mobile Vendors

Inventory management is a critical aspect of running a successful mobile vendor business. Portable POS systems play a crucial role in streamlining inventory management processes, ensuring accurate stock levels, and optimizing inventory. Let’s explore how these systems contribute to efficient inventory management for mobile vendors.

- Real-Time Stock Updates: Portable POS systems provide real-time stock updates, allowing vendors to track inventory levels accurately. As sales are made, the system automatically deducts the sold items from the inventory, ensuring accurate stock information at all times. This feature helps vendors avoid stockouts, optimize their inventory, and make informed decisions about restocking.

- Product Variations and Bundles: Many mobile vendors offer products with variations, such as different sizes, flavors, or colors. Portable POS systems allow vendors to manage these variations efficiently. Vendors can easily create product variations, track stock levels for each variation, and generate reports. This feature helps vendors ensure they have the right variations available and avoid overselling or underselling specific options.

- Reorder Points and Alerts: Portable POS systems enable vendors to set reorder points for their products. When the stock level reaches the reorder point, the system sends alerts to vendors, reminding them to restock. This feature helps vendors avoid stockouts and ensures they have sufficient inventory to meet customer demand. By setting appropriate reorder points, vendors can optimize their inventory and reduce the risk of lost sales.

- Supplier Management: Portable POS systems often include supplier management features, allowing vendors to track supplier information, manage purchase orders, and generate reports. Vendors can easily view supplier details, track order statuses, and monitor delivery times. This feature helps vendors maintain strong relationships with suppliers, ensure timely deliveries, and manage their inventory effectively.

- Barcode Scanning: Portable POS systems often support barcode scanning, making inventory management more efficient. Vendors can easily scan product barcodes using a mobile device or a connected barcode scanner. The system automatically updates the inventory, deducting the sold items and providing accurate stock information. Barcode scanning reduces manual data entry, minimizes errors, and speeds up the inventory management process.

- Product Categorization and Organization: Portable POS systems allow vendors to categorize and organize their products, making it easier to manage inventory. Vendors can create product categories, assign products to specific categories, and generate reports based on categories. This feature helps vendors quickly locate products, analyze sales by category, and make informed decisions about product offerings.

- Historical Sales Data: Portable POS systems store historical sales data, allowing vendors to analyze past performance and make data-driven decisions. Vendors can access sales reports, track trends, and identify top-selling products. This information helps vendors optimize their product offerings, adjust pricing strategies, and plan for future inventory needs. By analyzing historical sales data, vendors can identify opportunities for growth and maximize their profitability.

- Integration with Suppliers and E-commerce Platforms: Portable POS systems often integrate with suppliers and e-commerce platforms, streamlining inventory management processes. Vendors can easily sync their inventory with suppliers, receive real-time updates on stock availability, and automate the ordering process. Additionally, integration with e-commerce platforms ensures that inventory levels are synchronized across all sales channels, reducing the risk of overselling or underselling.

Ensuring Data Security and Compliance with Portable POS Systems for Mobile Vendors

Data security and compliance are critical considerations when choosing a portable POS system. Mobile vendors handle sensitive customer information, such as payment card details, and must ensure the protection of this data. Here are some measures to ensure data security and compliance:

- PCI DSS Compliance: The portable POS system should comply with the Payment Card Industry Data Security Standard (PCI DSS). This is a set of security standards designed to protect cardholder data and prevent fraud. Compliance with PCI DSS ensures that the portable POS system meets industry best practices for data security.

- End-to-End Encryption: The portable POS system should support end-to-end encryption, which ensures that sensitive data is encrypted from the point of capture until it reaches the payment processor. This prevents unauthorized access to customer payment information and reduces the risk of data breaches.

- Tokenization: Tokenization is another security measure that can be implemented by the portable POS system. It replaces sensitive data, such as credit card numbers, with unique tokens. These tokens are meaningless to hackers and cannot be used to retrieve the original data. Tokenization adds an extra layer of security to customer payment information.

- Secure Network Connectivity: The portable POS system should have secure network connectivity options, such as Wi-Fi with WPA2 encryption or 4G with secure data transmission protocols. This ensures that customer data is transmitted securely between the portable POS device and the payment processor.

- Regular Software Updates: It is essential to choose a portable POS system that receives regular software updates. These updates often include security patches and bug fixes, ensuring that the system remains secure and up to date with the latest security standards.

Integrating Portable POS Systems with Online Platforms: Expanding Mobile Vendor Reach

Integrating portable POS systems with online platforms can significantly expand the reach of mobile vendors. By offering online ordering, delivery services, or integrating with e-commerce platforms, mobile vendors can tap into a broader customer base. Here are some benefits and strategies for integrating portable POS systems with online platforms:

- Increased Visibility: By integrating with online platforms, mobile vendors can increase their visibility and reach a wider audience. Customers who prefer online ordering or delivery services can discover and engage with mobile vendors, even if they are not physically present at a specific location.

- Seamless Omnichannel Experience: Portable POS systems that integrate with online platforms provide a seamless omnichannel experience for customers. They can place orders online, make payments through the portable POS system, and choose between pickup or delivery options. This flexibility enhances the customer experience and allows vendors to cater to different customer preferences.

- Order Management and Fulfillment: Integrating portable POS systems with online platforms streamlines order management and fulfillment processes. Orders placed online are automatically synced with the portable POS system, eliminating the need for manual entry. Vendors can efficiently manage orders, track their status, and ensure timely fulfillment.

- Inventory Synchronization: When a sale is made through an online platform, the portable POS system automatically updates the inventory levels. This ensures accurate stock tracking and prevents overselling or running out of stock. By synchronizing inventory across online and offline channels, vendors can provide real-time product availability information to customers.

- Customer Data Integration: Integrating portable POS systems with online platforms allows for seamless integration of customer data. Customer information, such as contact details, purchase history, and preferences, can be shared between the portable POS system and the online platform. This enables vendors to provide personalized recommendations, targeted promotions, and loyalty programs across all channels.

FAQs

Q1. What is a portable POS system?

A portable POS system is a mobile device or tablet-based solution that enables mobile vendors to accept payments and manage transactions on the go. It typically includes a card reader, a software application, and connectivity options such as Wi-Fi or 4G.

Q2. How do portable POS systems benefit mobile vendors?

Portable POS systems offer several benefits for mobile vendors, including increased mobility and flexibility, increased sales and revenue, improved efficiency and accuracy, enhanced customer experience, real-time reporting and analytics, and streamlined inventory management.

Q3. Can portable POS systems accept different payment methods?

Yes, portable POS systems can accept various payment methods, including credit cards, debit cards, mobile wallets, and contactless payments. They offer flexibility and convenience for both vendors and customers.

Q4. Are portable POS systems secure?

Portable POS systems should comply with industry security standards, such as PCI DSS, to ensure the protection of customer payment information. They should support end-to-end encryption and tokenization to safeguard sensitive data.

Conclusion

Portable POS systems have become indispensable tools for mobile vendors, offering mobility, flexibility, and enhanced efficiency. These systems enable vendors to accept various payment methods, increase sales, and provide a seamless customer experience. With real-time inventory management capabilities, portable POS systems streamline operations, reduce manual effort, and optimize inventory levels.

By choosing a system with the right features and considering factors such as payment options, ease of use, and security, mobile vendors can leverage the benefits of portable POS systems to grow their business and stay ahead in the competitive market.