In today’s digital age, Point of Sale (POS) systems play a crucial role in facilitating transactions for businesses of all sizes. However, with the increasing prevalence of cyber threats and data breaches, it is essential for modern POS systems to incorporate robust security features to safeguard transactions and protect sensitive customer data. This article will explore various security features in modern POS systems, including end-to-end encryption, tokenization, multi-factor authentication, secure remote access, data encryption at rest, fraud detection and prevention, and compliance with industry standards.

What is End-to-End Encryption?

End-to-end encryption is a security measure that ensures the confidentiality and integrity of data transmitted between two parties. In the context of POS systems, end-to-end encryption ensures that sensitive customer information, such as credit card details, remains encrypted throughout the entire transaction process, from the moment it is entered into the POS system until it reaches the payment processor.

How Does End-to-End Encryption Work in POS Systems?

End-to-end encryption in POS systems involves the use of encryption algorithms to scramble the customer’s payment information into an unreadable format. This encrypted data is then securely transmitted to the payment processor, where it is decrypted and processed. The encryption keys used to encrypt and decrypt the data are securely managed and stored to prevent unauthorized access.

Benefits of End-to-End Encryption in POS Systems

End-to-end encryption offers several benefits in POS systems. Firstly, it ensures that sensitive customer data is protected from interception and unauthorized access during transmission. This significantly reduces the risk of data breaches and identity theft. Secondly, end-to-end encryption provides customers with peace of mind, knowing that their payment information is secure. This can enhance customer trust and loyalty, leading to increased customer satisfaction and repeat business. Lastly, end-to-end encryption helps businesses comply with data protection regulations and industry standards, as it provides a strong security measure to protect customer data.

What is Tokenization?

Tokenization is a data security technique that replaces sensitive information, such as credit card numbers, with unique tokens. These tokens are randomly generated and have no meaningful correlation to the original data. The sensitive data is securely stored in a separate system, known as a token vault, while the tokens are used for transaction processing.

How Does Tokenization Enhance Data Security in POS Systems?

Tokenization enhances data security in POS systems by reducing the risk of data breaches. Since the tokens have no meaningful correlation to the original data, even if they are intercepted or stolen, they cannot be used to retrieve the sensitive information. This significantly reduces the value of the data to potential attackers. Additionally, tokenization eliminates the need for businesses to store sensitive customer data within their POS systems, further reducing the risk of data exposure.

Advantages of Tokenization in POS Systems

Tokenization offers several advantages in POS systems. Firstly, it simplifies the Payment Card Industry Data Security Standard (PCI DSS) compliance process. By removing sensitive data from the POS system, businesses can reduce the scope of their PCI DSS assessments, making compliance easier and more cost-effective. Secondly, tokenization reduces the risk of data breaches and minimizes the potential impact on businesses and customers. Even if a breach occurs, the stolen tokens are useless without access to the token vault. Lastly, tokenization enhances customer trust and confidence, as they know that their sensitive information is being protected.

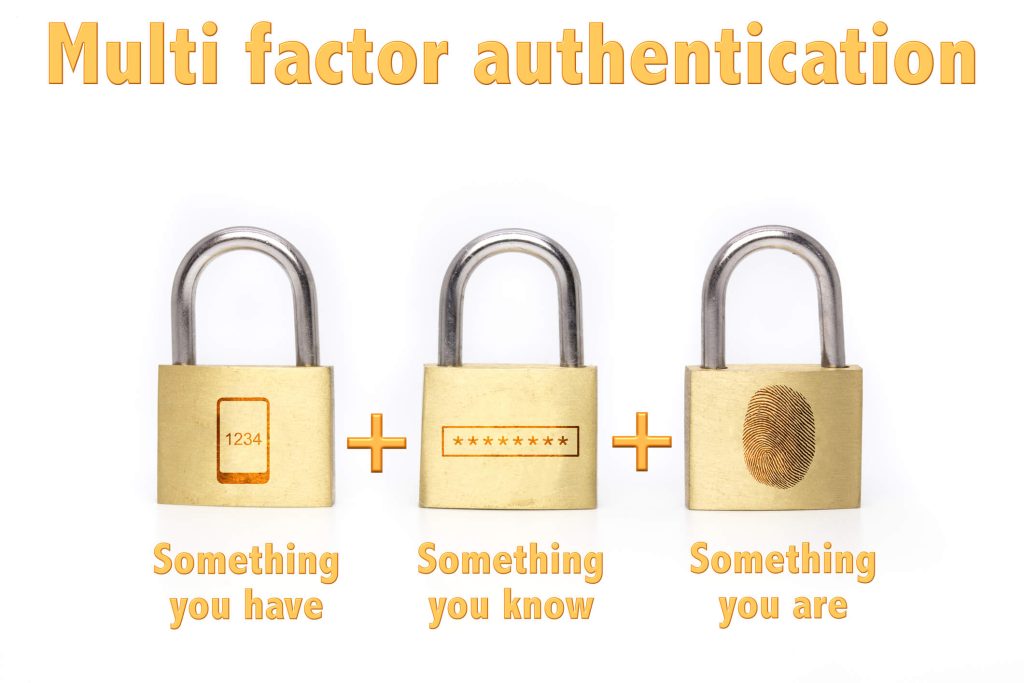

What is Multi-Factor Authentication?

Multi-factor authentication (MFA) is a security measure that requires users to provide multiple forms of identification to access a system or application. It adds an extra layer of security beyond traditional username and password authentication by combining something the user knows (e.g., a password), something the user has (e.g., a mobile device), and something the user is (e.g., a fingerprint).

Implementing Multi-Factor Authentication in POS Systems

Implementing multi-factor authentication in POS systems involves integrating additional authentication factors, such as biometric scans, one-time passwords, or hardware tokens, into the login process. Users are required to provide these additional factors along with their username and password to gain access to the POS system. This ensures that even if one factor is compromised, the attacker would still need to bypass the other factors to gain unauthorized access.

Benefits of Multi-Factor Authentication in POS Systems

Multi-factor authentication offers several benefits in POS systems. Firstly, it significantly reduces the risk of unauthorized access and identity theft. Even if an attacker manages to obtain a user’s password, they would still need to provide the additional authentication factors to gain access. This adds an extra layer of protection against brute-force attacks and stolen credentials. Secondly, multi-factor authentication enhances accountability and traceability by providing a unique identifier for each user. This helps businesses track and monitor user activities, reducing the risk of insider threats. Lastly, multi-factor authentication helps businesses comply with industry regulations and standards that require strong authentication measures.

The Importance of Secure Remote Access in POS Systems

Secure remote access is essential in POS systems to enable authorized personnel to remotely manage and monitor the system while ensuring that unauthorized individuals cannot gain access. It allows businesses to efficiently troubleshoot issues, perform software updates, and monitor sales and inventory data from anywhere, while maintaining the security and integrity of the system.

Best Practices for Secure Remote Access in POS Systems

To ensure secure remote access in POS systems, businesses should follow best practices such as implementing strong authentication measures, using secure communication protocols (e.g., SSL/TLS), regularly updating and patching remote access software, and monitoring and logging remote access activities. Additionally, businesses should restrict remote access privileges to authorized personnel only and regularly review and revoke access for employees who no longer require it.

Mitigating Risks with Secure Remote Access in POS Systems

Secure remote access helps mitigate risks in POS systems by reducing the likelihood of unauthorized access and data breaches. By implementing strong authentication measures and secure communication protocols, businesses can ensure that only authorized individuals can remotely access the system. Regular monitoring and logging of remote access activities can help detect and respond to any suspicious or unauthorized access attempts promptly.

Understanding Data Encryption at Rest in POS Systems

Data encryption at rest is the process of encrypting data when it is stored on a storage device, such as a hard drive or a database. In the context of POS systems, data encryption at rest ensures that sensitive customer information, including transaction details and payment data, remains encrypted and protected from unauthorized access.

Implementing Data Encryption at Rest in POS Systems

Implementing data encryption at rest in POS systems involves encrypting the stored data using encryption algorithms and securely managing the encryption keys. This ensures that even if the storage device is compromised or stolen, the encrypted data remains unreadable without the encryption keys. Additionally, businesses should regularly update and patch their encryption software to address any vulnerabilities and ensure the ongoing security of the stored data.

Advantages of Data Encryption at Rest in POS Systems

Data encryption at rest offers several advantages in POS systems. Firstly, it provides an additional layer of protection for sensitive customer data, reducing the risk of data breaches and unauthorized access. Even if the storage device is compromised, the encrypted data remains unreadable without the encryption keys. Secondly, data encryption at rest helps businesses comply with data protection regulations and industry standards that require the protection of stored data. Lastly, data encryption at rest enhances customer trust and confidence, as they know that their information is being securely stored and protected.

The Significance of Fraud Detection and Prevention in POS Systems

Fraud detection and prevention are crucial in POS systems to identify and stop potential threats, such as fraudulent transactions, unauthorized access attempts, and suspicious activities. By implementing effective fraud detection and prevention measures, businesses can minimize financial losses, protect customer data, and maintain the integrity of their POS systems.

Strategies for Effective Fraud Detection and Prevention in POS Systems

Effective fraud detection and prevention in POS systems involve implementing strategies such as real-time transaction monitoring, anomaly detection, rule-based alerts, and machine learning algorithms. Real-time transaction monitoring allows businesses to identify and flag suspicious transactions as they occur, enabling timely intervention. Anomaly detection involves analyzing transaction patterns and identifying deviations from normal behavior, which may indicate fraudulent activities. Rule-based alerts allow businesses to define specific rules and thresholds for triggering alerts when certain conditions are met. Machine learning algorithms can analyze large volumes of data and identify patterns and anomalies that may indicate fraudulent activities.

Tools and Technologies for Fraud Detection and Prevention in POS Systems

There are various tools and technologies available for fraud detection and prevention in POS systems. These include fraud detection software, machine learning algorithms, data analytics tools, and transaction monitoring systems. Fraud detection software can analyze transaction data in real-time and identify potential fraud indicators. Machine learning algorithms can learn from historical data and detect patterns and anomalies that may indicate fraudulent activities. Data analytics tools can help businesses analyze large volumes of data and identify trends and patterns that may indicate fraudulent activities. Transaction monitoring systems can continuously monitor transactions and flag suspicious activities for further investigation.

Overview of Industry Standards for POS System Security

Compliance with industry standards is essential for POS systems to ensure that they meet the necessary security requirements. The Payment Card Industry Data Security Standard (PCI DSS) is one of the most widely recognized industry standards for POS system security. It sets forth a comprehensive framework of security requirements that businesses must adhere to when processing, storing, or transmitting cardholder data. Other industry standards, such as the ISO/IEC 27001 and the National Institute of Standards and Technology (NIST) Cybersecurity Framework, provide additional guidance and best practices for securing POS systems.

Achieving Compliance with Industry Standards in POS Systems

Achieving compliance with industry standards in POS systems involves implementing a range of security measures and best practices. These may include implementing strong access controls, regularly updating and patching software, conducting regular vulnerability assessments and penetration testing, encrypting sensitive data, and maintaining audit logs. Additionally, businesses must undergo regular audits and assessments to ensure ongoing compliance with industry standards.

Benefits of Compliance with Industry Standards in POS Systems

Compliance with industry standards offers several benefits in POS systems. Firstly, it helps businesses protect sensitive customer data and reduce the risk of data breaches and financial losses. By adhering to industry standards, businesses can implement robust security measures and best practices that are recognized and recommended by industry experts. Secondly, compliance with industry standards enhances customer trust and confidence. Customers are more likely to trust businesses that demonstrate a commitment to protecting their data and complying with industry regulations. Lastly, compliance with industry standards helps businesses avoid penalties and legal consequences associated with non-compliance.

FAQs

Q.1: What are the essential security features to look for in a modern POS system?

Essential security features to look for in a modern POS system include end-to-end encryption, tokenization, multi-factor authentication, secure remote access, data encryption at rest, fraud detection and prevention tools, and compliance with industry standards. These features work together to protect transactions and data, minimize the risk of data breaches, and ensure regulatory compliance.

Q.2: How does end-to-end encryption protect sensitive customer data?

End-to-end encryption protects sensitive customer data by encrypting it throughout the entire transaction process, from the moment it is entered into the POS system until it reaches the payment processor. This ensures that even if the data is intercepted or stolen, it remains unreadable without the encryption keys.

Q.3: Can tokenization prevent data breaches in POS systems?

Tokenization can help prevent data breaches in POS systems by replacing sensitive data with unique tokens. Even if the tokens are intercepted or stolen, they cannot be used to retrieve the original data without access to the token vault. This significantly reduces the value of the data to potential attackers.

Q.4: What are the common types of multi-factor authentication methods used in POS systems?

Common types of multi-factor authentication methods used in POS systems include biometric scans (e.g., fingerprint or facial recognition), one-time passwords, hardware tokens, and mobile device authentication. These additional authentication factors add an extra layer of security beyond traditional username and password authentication.

Q.5: How does secure remote access enhance the security of POS systems?

Secure remote access enhances the security of POS systems by allowing authorized personnel to remotely manage and monitor the system while ensuring that unauthorized individuals cannot gain access. It enables businesses to efficiently troubleshoot issues, perform software updates, and monitor sales and inventory data from anywhere, while maintaining the security and integrity of the system.

Q.6: What is the role of data encryption at rest in securing stored information?

Data encryption at rest plays a crucial role in securing stored information by encrypting the data when it is stored on a storage device. This ensures that even if the storage device is compromised or stolen, the encrypted data remains unreadable without the encryption keys.

Q.7: How can fraud detection and prevention tools help in safeguarding POS systems?

Fraud detection and prevention tools can help safeguard POS systems by identifying and stopping potential threats, such as fraudulent transactions, unauthorized access attempts, and suspicious activities. These tools use various techniques, such as real-time transaction monitoring, anomaly detection, and machine learning algorithms, to detect patterns and anomalies that may indicate fraudulent activities.

Q.8: Which industry standards should a modern POS system comply with?

A modern POS system should comply with industry standards such as the Payment Card Industry Data Security Standard (PCI DSS), ISO/IEC 27001, and the National Institute of Standards and Technology (NIST) Cybersecurity Framework. These standards provide guidance and best practices for securing POS systems and protecting sensitive customer data.

Conclusion

In conclusion, modern POS systems incorporate various security features to ensure the protection of transactions and data. End-to-end encryption safeguards sensitive customer information, while tokenization adds an extra layer of security by replacing sensitive data with tokens. Multi-factor authentication strengthens access control, and secure remote access protects POS systems from external threats. Data encryption at rest secures stored information, and fraud detection and prevention tools help identify and