In the world of accounting, there are various methods and principles that help businesses accurately record and report their financial transactions. One such method is FIFO, which stands for First-In, First-Out. FIFO is a widely used inventory valuation method that assumes that the first items purchased or produced are the first ones to be sold or used.

This article will provide a comprehensive understanding of FIFO in accounting, including its concept, benefits, implementation, challenges, and its importance in financial statements, cost of goods sold calculation, taxation, and compliance.

Understanding the Concept of FIFO

First In, First Out is based on the principle that the oldest inventory items are sold or used first, while the newest items remain in inventory. This concept is particularly relevant in industries where products have a limited shelf life or where the cost of inventory fluctuates significantly over time. By assuming that the oldest items are sold first, FIFO ensures that the cost of goods sold (COGS) reflects the most recent prices paid for inventory, resulting in a more accurate representation of the company’s profitability.

To illustrate the concept of FIFO, let’s consider a simple example. Imagine a retail store that sells clothing. At the beginning of the year, the store purchases 100 shirts at $10 each. A few months later, when the price of shirts increases to $15, the store purchases an additional 100 shirts.

If the store sells 150 shirts during the year, First In, First Out would assume that the first 100 shirts sold were the ones purchased at $10 each, and the remaining 50 shirts sold were the ones purchased at $15 each. This ensures that the COGS reflects the most recent prices paid for inventory.

Benefits of Using FIFO Method in Accounting

The FIFO method offers several benefits to businesses, making it a popular choice for inventory valuation. One of the key advantages is that it provides a more accurate representation of the company’s profitability.

By valuing inventory based on the most recent prices paid, First In, First Out ensures that the COGS reflects the current market value of the goods sold. This is particularly important in industries where the cost of inventory fluctuates significantly, as it allows businesses to adapt to changing market conditions and make informed decisions.

Another benefit of using FIFO is that it aligns with the natural flow of inventory. In many industries, such as manufacturing or retail, it is common for older inventory items to be sold or used before newer ones.

By following this natural flow, First In, First Out provides a logical and intuitive method of inventory valuation. This can simplify the accounting process and make it easier for businesses to track their inventory and understand their financial position.

Furthermore, FIFO can also help businesses minimize their tax liability. In many countries, including the United States, the cost of goods sold is deductible for tax purposes. By valuing inventory based on the most recent prices paid, First In, First Out can result in a higher COGS, which in turn reduces taxable income and lowers the tax liability.

This can be particularly advantageous for businesses operating in industries with volatile prices, as it allows them to offset higher costs against their revenue.

How FIFO Method Works in Inventory Valuation

The FIFO method works by assigning the cost of the oldest inventory items to the goods sold or used first. This is done by assuming that the first items purchased or produced are the first ones to be sold or used. As a result, the cost of goods sold reflects the most recent prices paid for inventory, while the ending inventory reflects the cost of the newest items.

To illustrate how FIFO works in inventory valuation, let’s continue with the example of the retail store selling clothing. At the beginning of the year, the store purchases 100 shirts at $10 each. A few months later, when the price of shirts increases to $15, the store purchases an additional 100 shirts. If the store sells 150 shirts during the year, First In, First Out (FIFO) would assume that the first 100 shirts sold were the ones purchased at $10 each, and the remaining 50 shirts sold were the ones purchased at $15 each.

Based on this assumption, the cost of goods sold would be calculated as follows:

100 shirts at $10 each = $1,000

50 shirts at $15 each = $750

Total cost of goods sold = $1,000 + $750 = $1,750

The ending inventory would be calculated as follows:

50 shirts at $15 each = $750

By following the FIFO method, the cost of goods sold reflects the most recent prices paid for inventory, while the ending inventory reflects the cost of the newest items. This provides a more accurate representation of the company’s profitability and the value of its inventory.

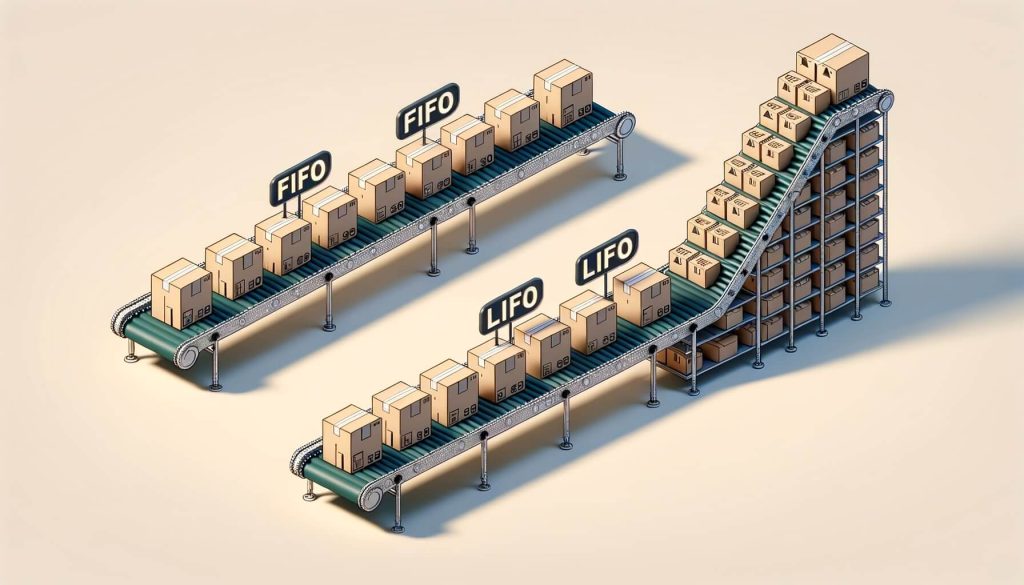

FIFO vs. LIFO: A Comparison of Inventory Valuation Methods

In addition to FIFO, another commonly used inventory valuation method is LIFO, which stands for Last-In, First-Out. While First In, First Out assumes that the oldest inventory items are sold or used first, LIFO assumes that the newest items are sold or used first. This creates a different valuation of inventory and can have significant implications for a company’s financial statements and tax liability.

One of the key differences between FIFO and LIFO is their impact on the cost of goods sold. As we have seen earlier, First In, First Out (FIFO) assigns the cost of the oldest inventory items to the goods sold first, resulting in a COGS that reflects the most recent prices paid for inventory. In contrast, LIFO assigns the cost of the newest inventory items to the goods sold first, resulting in a COGS that reflects the oldest prices paid for inventory.

The choice between FIFO and LIFO can have a significant impact on a company’s financial statements, particularly in industries with volatile prices. In periods of rising prices, LIFO tends to result in a higher COGS and a lower ending inventory compared to FIFO. This can lead to lower reported profits and lower taxable income, as well as a lower value of inventory on the balance sheet. On the other hand, in periods of falling prices, First In, First Out tends to result in a higher COGS and a lower ending inventory compared to LIFO.

Implementing FIFO Method in Financial Statements

Implementing the FIFO method in financial statements requires careful record-keeping and adherence to accounting principles. The first step is to accurately track the purchase and sale of inventory items, including the quantity and cost of each item. This information is then used to calculate the cost of goods sold and the ending inventory.

To illustrate how First In, First Out is implemented in financial statements, let’s consider a manufacturing company that produces electronic devices. At the beginning of the year, the company purchases 1,000 microchips at $5 each. A few months later, when the price of microchips increases to $7, the company purchases an additional 1,000 microchips. If the company sells 1,500 microchips during the year, FIFO would assume that the first 1,000 microchips sold were the ones purchased at $5 each, and the remaining 500 microchips sold were the ones purchased at $7 each.

Based on this assumption, the cost of goods sold would be calculated as follows:

1,000 microchips at $5 each = $5,000

500 microchips at $7 each = $3,500

Total cost of goods sold = $5,000 + $3,500 = $8,500

The ending inventory would be calculated as follows:

500 microchips at $7 each = $3,500

By accurately tracking the purchase and sale of inventory items and applying the FIFO method, the company can calculate the cost of goods sold and the ending inventory, which are then reported in the financial statements. This provides stakeholders with a clear understanding of the company’s profitability and the value of its inventory.

Challenges and Limitations of FIFO Method

While FIFO is a widely used inventory valuation method, it is not without its challenges and limitations. One of the main challenges is the need for accurate record-keeping and inventory tracking. In order to implement First In, First Out (FIFO) effectively, businesses must have a robust system in place to track the purchase and sale of inventory items, including the quantity and cost of each item. This can be particularly challenging for businesses with a large volume of inventory or multiple locations.

Another challenge of First In, First Out is its potential to overstate the value of inventory during periods of rising prices. Since FIFO assumes that the oldest inventory items are sold or used first, the ending inventory reflects the cost of the newest items. In periods of rising prices, this can result in an ending inventory that is valued at higher prices than the current market value. This can lead to an overstatement of assets on the balance sheet and a distortion of the company’s financial position.

Furthermore, FIFO may not be suitable for all industries or types of inventory. For example, in industries where products have a limited shelf life, such as food or pharmaceuticals, First In, First Out may not accurately reflect the value of inventory. In these cases, other inventory valuation methods, such as weighted average cost or specific identification, may be more appropriate.

FIFO Method in Cost of Goods Sold Calculation

One of the key applications of the FIFO method is in the calculation of the cost of goods sold (COGS). The COGS represents the direct costs associated with the production or purchase of goods that are sold during a specific period. By using the FIFO method, businesses can ensure that the COGS reflects the most recent prices paid for inventory, resulting in a more accurate representation of the company’s profitability.

To calculate the COGS using the FIFO method, businesses need to know the quantity and cost of each inventory item purchased or produced. The first step is to determine the cost of the oldest inventory items that were sold or used during the period. This is done by multiplying the quantity of each item sold or used by its respective cost. The costs of all the items sold or used are then added together to calculate the total cost of goods sold.

For example, let’s consider a bakery that produces and sells bread. At the beginning of the month, the bakery has 100 loaves of bread in inventory, which were purchased at $2 each. During the month, the bakery produces an additional 200 loaves of bread at a cost of $1.50 each. If the bakery sells 250 loaves of bread during the month, FIFO would assume that the first 100 loaves sold were the ones purchased at $2 each, and the remaining 150 loaves sold were the ones produced at $1.50 each.

Based on this assumption, the cost of goods sold would be calculated as follows:

100 loaves at $2 each = $200

150 loaves at $1.50 each = $225

Total cost of goods sold = $200 + $225 = $425

By using the FIFO method to calculate the cost of goods sold, the bakery can accurately determine the direct costs associated with the production or purchase of the bread that was sold during the month.

FIFO Method in Taxation and Compliance

The FIFO method also has implications for taxation and compliance. In many countries, including the United States, the cost of goods sold is deductible for tax purposes. By valuing inventory based on the most recent prices paid, FIFO can result in a higher COGS, which in turn reduces taxable income and lowers the tax liability.

For example, let’s consider a retailer that purchases inventory at different prices throughout the year. If the retailer uses the FIFO method to value its inventory, the cost of goods sold will reflect the most recent prices paid. This can result in a higher COGS compared to other inventory valuation methods, such as LIFO or weighted average cost. As a result, the retailer’s taxable income will be lower, and its tax liability will be reduced.

In addition to taxation, the FIFO method also helps businesses comply with accounting standards and regulations. In many countries, including the United States, the Generally Accepted Accounting Principles (GAAP) require businesses to use a consistent and logical method for inventory valuation. By following the natural flow of inventory and valuing the oldest items first, FIFO provides a logical and intuitive method of inventory valuation that is in line with accounting principles.

FAQs

Q1. Is FIFO the only method of inventory valuation?

No, FIFO is one of several methods of inventory valuation. Other commonly used methods include LIFO (Last-In, First-Out), weighted average cost, and specific identification.

Q2. Can a company switch between FIFO and LIFO?

Yes, a company can switch between FIFO and LIFO, but it must disclose the change in its financial statements. The change must also be applied retrospectively, meaning that the financial statements for previous periods must be restated to reflect the new method.

Q3. Does FIFO always result in a higher ending inventory value compared to LIFO?

Not necessarily. The ending inventory value depends on the cost of the inventory items and the quantity sold. In periods of rising prices, FIFO may result in a higher ending inventory value, but in periods of falling prices, LIFO may result in a higher ending inventory value.

Q4. Can FIFO be used for both perpetual and periodic inventory systems?

Yes, FIFO can be used for both perpetual and periodic inventory systems. In a perpetual system, the cost of goods sold and ending inventory are updated in real-time as inventory items are purchased and sold. In a periodic system, the cost of goods sold and ending inventory are calculated at the end of the accounting period based on physical counts and cost assumptions.

Q5. Are there any industries where FIFO is not suitable?

While FIFO is suitable for most industries, there are some exceptions. For example, in industries where the value of inventory items tends to decrease over time, such as in the case of technology products, using FIFO may result in an overvaluation of ending inventory.

Conclusion

In conclusion, FIFO is a widely used inventory valuation method in accounting that assumes that the first items purchased or produced are the first ones to be sold or used. This method provides several benefits, including a more accurate representation of a company’s profitability, alignment with the natural flow of inventory, and potential tax savings.

By valuing inventory based on the most recent prices paid, FIFO ensures that the cost of goods sold reflects the current market value of the goods sold. However, FIFO also has its challenges and limitations, such as the need for accurate record-keeping and the potential to overstate the value of inventory during periods of rising prices. Despite these challenges, FIFO remains an important tool in accounting, helping businesses accurately record and report their financial transactions.