Cash registers are an essential tool for businesses of all sizes, allowing them to efficiently process transactions and keep track of sales. These machines have come a long way since their inception, evolving from mechanical devices to sophisticated electronic systems.

In this article, we will explore the evolution of cash registers, their components and functions, different types available in the market, benefits of using them in businesses, how to choose the right one for your business, setting up and operating a cash register, common issues and troubleshooting tips, and answer frequently asked questions about cash registers.

Evolution of Cash Registers: From Mechanical to Electronic

The history of cash registers dates back to the late 19th century when James Ritty, a saloon owner, invented the first mechanical cash register in 1879. This early version was a simple device that recorded sales and prevented theft by providing a receipt for each transaction. Over time, cash registers underwent significant advancements, transitioning from mechanical to electronic systems.

Mechanical cash registers were operated by hand and relied on a series of gears, levers, and springs to perform calculations and print receipts. These machines were bulky and required manual input for each transaction. However, they revolutionized the retail industry by providing a more accurate and efficient method of recording sales.

In the 1970s, electronic cash registers were introduced, incorporating microprocessors and digital displays. These machines offered enhanced functionality, such as automatic tax calculations, inventory management, and the ability to store transaction data electronically. The shift to electronic cash registers marked a significant milestone in the evolution of this technology, making it easier for businesses to streamline their operations and improve efficiency.

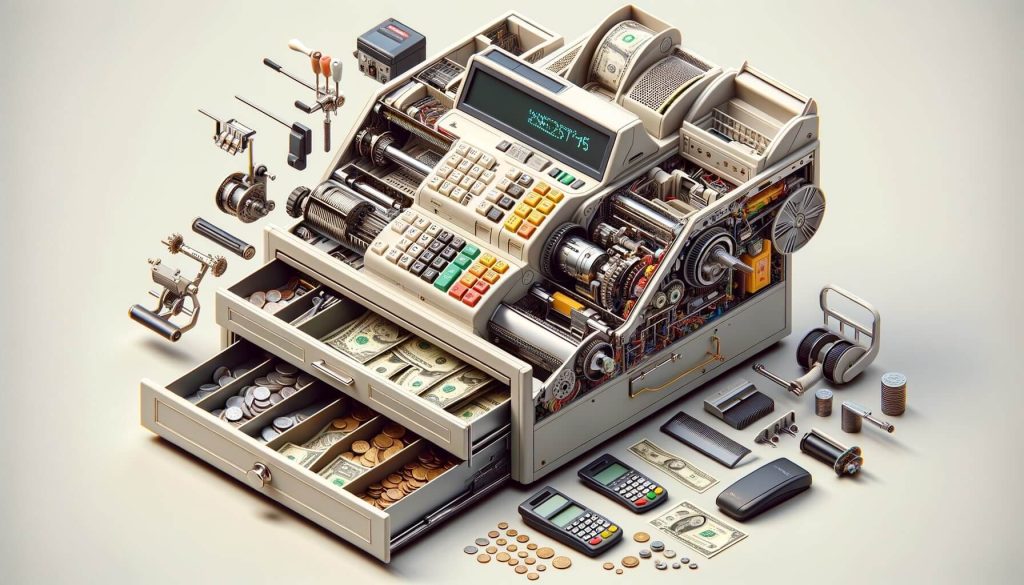

Components and Functions of a Cash Register

A cash register consists of several key components that work together to facilitate transactions and record sales. These components include a cash drawer, a receipt printer, a display screen, a keyboard or touchpad, and a central processing unit (CPU).

The cash drawer is where cash, coins, and checks are stored securely. It is typically located at the front of the cash register and can be locked to prevent unauthorized access. The receipt printer is responsible for printing receipts for customers, providing them with a record of their purchase.

The display screen, often an LCD or LED panel, shows important information such as the total amount due, itemized prices, and transaction details. The keyboard or touchpad allows the cashier to input prices, quantities, and other relevant information. The CPU, the brain of the cash register, processes the data entered and performs calculations, such as adding up the total amount due and calculating change.

Types of Cash Registers: Basic, Advanced, and Specialized

Cash registers come in various types, each designed to cater to specific business needs. The three main categories are basic cash registers, advanced cash registers, and specialized cash registers.

Basic cash registers are suitable for small businesses with simple transaction requirements. They typically offer basic functions such as calculating totals, printing receipts, and opening the cash drawer. These machines are affordable and easy to use, making them ideal for businesses with limited budgets or minimal technical expertise.

Advanced cash registers, on the other hand, are more sophisticated and offer a wide range of features. They often include advanced inventory management capabilities, barcode scanning, employee tracking, and integration with other business systems such as point-of-sale (POS) software. These cash registers are suitable for medium to large businesses that require more advanced functionality and reporting capabilities.

Specialized cash registers are designed for specific industries or business types. For example, restaurants may use cash registers with built-in features for table management, order taking, and splitting bills. Similarly, retail stores may opt for cash registers with integrated weighing scales or barcode scanners. These specialized cash registers cater to the unique needs of specific industries, providing tailored solutions for efficient operations.

Benefits of Using Cash Registers in Businesses

Using cash registers in businesses offers numerous benefits, regardless of the size or type of operation. Let’s explore some of the key advantages:

1. Accurate and Efficient Transaction Processing: Cash registers automate the calculation of totals, reducing the risk of human error and ensuring accurate transaction processing. This saves time and eliminates the need for manual calculations, allowing cashiers to serve customers more efficiently.

2. Inventory Management: Many cash registers offer inventory management features, allowing businesses to track stock levels, monitor sales trends, and generate reports. This helps businesses optimize their inventory, reduce stockouts, and make informed purchasing decisions.

3. Sales Reporting and Analysis: Cash registers provide valuable insights into sales performance, allowing businesses to analyze trends, identify top-selling products, and make data-driven decisions. This information can be used to develop effective marketing strategies and improve overall business performance.

4. Enhanced Security: Cash registers help prevent theft and fraud by providing a secure storage space for cash and checks. They also generate receipts for each transaction, providing a record of sales that can be used for auditing purposes.

5. Streamlined Operations: Cash registers streamline business operations by automating tasks such as calculating change, printing receipts, and tracking sales. This frees up time for employees to focus on other important aspects of the business, such as customer service.

6. Improved Customer Service: With the ability to process transactions quickly and accurately, cash registers contribute to a positive customer experience. Customers appreciate the efficiency and professionalism of businesses that use cash registers, leading to increased customer satisfaction and loyalty.

How to Choose the Right Cash Register for Your Business

Choosing the right cash register for your business is crucial to ensure smooth operations and maximize efficiency. Consider the following factors when selecting a cash register:

1. Business Size and Type: Assess the size and type of your business to determine the level of functionality you require. Small businesses with basic transaction needs may opt for a simple cash register, while larger businesses may require more advanced features.

2. Budget: Set a budget for your cash register purchase, taking into account any additional costs such as software, peripherals, and ongoing maintenance. Consider the long-term value and return on investment when evaluating different options.

3. Features and Functionality: Identify the specific features and functionality you need in a cash register. Consider factors such as barcode scanning, inventory management, integration with other systems, and reporting capabilities. Make a list of must-have features and prioritize them based on your business requirements.

4. Ease of Use: Look for a cash register that is user-friendly and intuitive. Consider the training required for your employees to operate the machine effectively. A complicated cash register may lead to errors and inefficiencies if not properly understood by the staff.

5. Scalability: Consider the future growth and expansion plans of your business. Choose a cash register that can accommodate your evolving needs and can be easily upgraded or integrated with other systems as your business grows.

6. Support and Maintenance: Research the reputation and reliability of the cash register manufacturer or vendor. Ensure they offer adequate customer support, including technical assistance, software updates, and warranty coverage. Consider the availability of spare parts and the ease of maintenance for the chosen cash register model.

Setting Up and Operating a Cash Register

Setting up and operating a cash register requires careful attention to detail to ensure accurate transactions and smooth operations. Follow these steps to set up and operate your cash register effectively:

1. Unpack and Assemble: Carefully unpack the cash register and assemble any components according to the manufacturer’s instructions. Ensure all cables are connected securely and any necessary peripherals, such as barcode scanners or weighing scales, are properly integrated.

2. Configure Settings: Set up the cash register by configuring basic settings such as date and time, tax rates, and currency denominations. Consult the user manual or contact customer support for guidance on configuring specific settings for your business.

3. Input Product Information: Enter the product information into the cash register, including item names, prices, and any applicable tax rates. This step is crucial for accurate transaction processing and inventory management.

4. Train Employees: Provide comprehensive training to your employees on how to operate the cash register effectively. Cover topics such as entering sales, processing different payment methods, handling returns, and generating reports. Regularly update training materials to incorporate any software updates or new features.

5. Cash Handling Procedures: Establish clear cash handling procedures to ensure the security of cash and minimize the risk of theft. Train employees on how to handle cash, reconcile the cash drawer, and follow proper cash management protocols.

6. Regular Maintenance: Regularly clean and maintain the cash register to ensure optimal performance. Follow the manufacturer’s guidelines for cleaning and maintenance, and promptly address any technical issues or error messages.

Common Issues and Troubleshooting Tips for Cash Registers

Despite their reliability, cash registers may encounter occasional issues that can disrupt operations. Here are some common issues and troubleshooting tips to help you resolve them:

1. Cash Drawer Won’t Open: If the cash drawer fails to open, check if it is locked or jammed. Ensure that the cash register is properly connected to a power source and that the drawer release mechanism is functioning correctly. If the issue persists, consult the user manual or contact customer support for further assistance.

2. Error Messages: Error messages on the cash register display can indicate various issues, such as incorrect entries, connectivity problems, or software glitches. Refer to the user manual or contact customer support for guidance on interpreting and resolving specific error messages.

3. Printing Issues: If the receipt printer fails to print or produces illegible receipts, check if there is enough paper in the printer and that it is properly loaded. Ensure that the printer is connected securely and that the print head is clean. If the problem persists, consult the user manual or contact customer support for further troubleshooting steps.

4. Software Updates: Regularly update the cash register software to ensure optimal performance and access to the latest features. Check the manufacturer’s website or contact customer support for instructions on how to update the software.

5. Connectivity Problems: If the cash register is connected to other devices or systems, such as barcode scanners or POS software, ensure that the connections are secure and properly configured. Check for any loose cables or compatibility issues. If the problem persists, consult the user manual or contact customer support for further assistance.

Frequently Asked Questions

Q1. What is the difference between a cash register and a point-of-sale (POS) system?

A cash register is a standalone device used for processing transactions and recording sales, while a POS system is a more comprehensive solution that includes additional features such as inventory management, customer relationship management, and reporting capabilities. POS systems are typically more advanced and suitable for businesses with complex needs.

Q2. Can cash registers process credit card payments?

Some cash registers have built-in credit card processing capabilities, while others require additional hardware or software to accept credit card payments. Consult with your cash register vendor or payment processor to determine the best solution for your business.

Q3. Can cash registers be connected to other business systems?

Yes, many cash registers offer integration capabilities with other business systems such as accounting software, inventory management systems, and customer relationship management (CRM) software. This allows for seamless data transfer and improved efficiency in managing various aspects of the business.

Q4. How often should cash registers be audited?

Cash registers should be audited regularly to ensure accuracy and detect any discrepancies. The frequency of audits may vary depending on the size and nature of the business. Some businesses conduct daily audits, while others may perform them weekly or monthly. Consult with your accountant or financial advisor to determine the appropriate audit frequency for your business.

Q5. Can cash registers be used in online businesses?

Cash registers are primarily designed for brick-and-mortar businesses that process in-person transactions. However, there are POS systems available that cater specifically to online businesses, allowing them to process payments, manage inventory, and generate reports. These systems often integrate with e-commerce platforms and payment gateways to provide a seamless online shopping experience.

Conclusion

Cash registers have come a long way since their humble beginnings as mechanical devices. Today, they are sophisticated electronic systems that offer a wide range of features and benefits for businesses of all sizes. From accurate transaction processing to inventory management and sales reporting, cash registers play a crucial role in streamlining operations and improving efficiency.

When choosing a cash register for your business, consider factors such as your business size, budget, required features, ease of use, scalability, and support. Proper setup and operation of the cash register, along with regular maintenance, are essential for smooth operations and accurate transaction processing.

While cash registers are generally reliable, occasional issues may arise. Troubleshooting tips for common problems such as cash drawer issues, error messages, printing problems, and connectivity issues can help resolve these challenges.

By understanding the benefits, types, setup, operation, and troubleshooting of cash registers, businesses can make informed decisions and leverage this essential tool to enhance their operations, improve customer service, and drive overall business success.