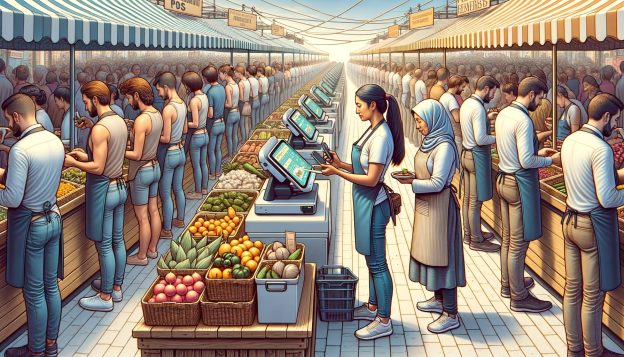

In today’s fast-paced world, pharmacies are facing increasing pressure to streamline their operations and provide efficient services to their customers. One way to achieve this is by implementing a pharmacy point-of-sale (POS) system. A pharmacy POS system is a software solution that helps manage various aspects of a pharmacy’s operations, including sales, inventory management, customer service, and reporting.

This article will explore the top pharmacy POS systems in the market, their key features and benefits, pricing, integration, and factors to consider when choosing a system.

Key Features and Benefits of Pharmacy Point-of-Sale Systems

Pharmacy Point-of-Sale systems offer a wide range of features and benefits that can significantly improve the efficiency and profitability of a pharmacy. Some key features include:

1. Prescription Management: A pharmacy Point-of-Sale system allows pharmacists to manage prescriptions efficiently. It can track prescription details, refill requests, and provide alerts for expired or out-of-stock medications.

2. Inventory Management: With a pharmacy POS system, pharmacies can effectively manage their inventory. It can track stock levels, generate purchase orders, and provide real-time updates on inventory status.

3. Sales and Payment Processing: Pharmacy POS systems enable seamless sales and payment processing. They can handle cash, credit card, and insurance payments, and generate detailed sales reports.

4. Customer Relationship Management (CRM): A pharmacy Point-of-Sale system can help pharmacies build and maintain strong relationships with their customers. It can store customer information, track purchase history, and send reminders for medication refills.

5. Reporting and Analytics: Pharmacy POS systems provide comprehensive reporting and analytics capabilities. They can generate sales reports, track profitability, and identify trends to make informed business decisions.

The benefits of using a pharmacy POS system are numerous. It can streamline operations, reduce errors, improve customer service, increase efficiency, and ultimately boost profitability.

Top Pharmacy Point-of-Sale Systems in the Market

PioneerRx: A Comprehensive Overview

PioneerRx is a leading pharmacy Point-of-Sale system that offers a comprehensive range of features to meet the unique needs of pharmacies. With its user-friendly interface and robust functionality, PioneerRx has gained popularity among independent and retail pharmacies alike. One of the standout features of PioneerRx is its ability to integrate with other healthcare systems, such as electronic health records (EHRs) and prescription monitoring programs (PMPs), allowing for seamless data exchange and improved patient care.

The inventory management capabilities of PioneerRx are also noteworthy. The system provides real-time tracking of stock levels, expiration dates, and drug recalls, ensuring that pharmacies can efficiently manage their inventory and avoid stockouts or wastage. Additionally, PioneerRx offers advanced reporting and analytics tools that enable pharmacies to gain valuable insights into their business performance, identify trends, and make data-driven decisions.

PrimeRx: Streamlining Pharmacy Operations

PrimeRx is another popular pharmacy POS system that focuses on streamlining pharmacy operations and improving efficiency. With its intuitive interface and customizable workflows, PrimeRx allows pharmacies to tailor the system to their specific needs and preferences. This flexibility is particularly beneficial for pharmacies with unique requirements or specialized services.

One of the standout features of PrimeRx is its robust prescription management capabilities. The system automates prescription processing, including electronic prescribing, refill requests, and prescription transfers, reducing the administrative burden on pharmacy staff and improving accuracy. PrimeRx also offers comprehensive medication therapy management (MTM) tools, enabling pharmacists to provide personalized care and optimize patient outcomes.

BestRx: Enhancing Efficiency and Customer Service

BestRx is a pharmacy Point-of-Sale system that prides itself on enhancing efficiency and customer service. With its user-friendly interface and intuitive design, BestRx is easy to learn and navigate, making it an ideal choice for pharmacies with varying levels of technical expertise. The system offers a range of features to streamline pharmacy operations, including prescription processing, inventory management, and patient profiles.

One of the standout features of BestRx is its robust customer relationship management (CRM) capabilities. The system allows pharmacies to store and access detailed patient profiles, including medication history, allergies, and preferences. This information enables pharmacists to provide personalized care and recommendations, improving patient satisfaction and loyalty. BestRx also offers integrated loyalty programs and automated refill reminders, further enhancing the customer experience.

Winpharm: Optimizing Workflow and Inventory Management

Winpharm is a pharmacy Point-of-Sale system that focuses on optimizing workflow and inventory management. With its user-friendly interface and customizable workflows, Winpharm allows pharmacies to streamline their operations and improve efficiency. The system offers a range of features to automate prescription processing, including electronic prescribing, prior authorization, and medication synchronization.

One of the standout features of Winpharm is its advanced inventory management capabilities. The system provides real-time tracking of stock levels, expiration dates, and drug recalls, allowing pharmacies to efficiently manage their inventory and reduce waste. Winpharm also offers barcode scanning and label printing functionalities, further streamlining the dispensing process and reducing errors.

Liberty: Empowering Independent Pharmacies

Liberty is a pharmacy Point-of-Sale system that is specifically designed to empower independent pharmacies. With its comprehensive range of features and affordable pricing, Liberty offers independent pharmacies the tools they need to compete with larger chains. The system provides a user-friendly interface and customizable workflows, allowing pharmacies to tailor the system to their specific needs and preferences.

One of the standout features of Liberty is its robust reporting and analytics capabilities. The system offers a wide range of pre-built reports, including sales, inventory, and financial reports, enabling pharmacies to gain valuable insights into their business performance. Liberty also offers integration with third-party services, such as prescription discount cards and medication synchronization programs, further enhancing the value proposition for independent pharmacies.

Rx30: A Trusted Solution for Pharmacy Management

Rx30 is a trusted pharmacy POS system that has been serving pharmacies for over 30 years. With its comprehensive range of features and industry expertise, Rx30 is a reliable choice for pharmacies of all sizes. The system offers a user-friendly interface and customizable workflows, allowing pharmacies to tailor the system to their specific needs and preferences.

One of the standout features of Rx30 is its robust medication therapy management (MTM) capabilities. The system provides comprehensive tools for medication reconciliation, adherence monitoring, and patient counseling, enabling pharmacists to optimize patient outcomes and improve medication safety. Rx30 also offers integration with other healthcare systems, such as EHRs and PMPs, allowing for seamless data exchange and improved patient care.

Comparison of Pharmacy Point-of-Sale Systems: Pricing, Features, and Integration

When choosing a pharmacy POS system, it is essential to consider factors like pricing, features, and integration capabilities. The pricing of pharmacy POS systems can vary depending on the vendor and the specific features included. It is important to evaluate the pricing structure, including any additional fees for support or updates.

In terms of features, it is crucial to assess the specific needs of the pharmacy and choose a system that offers the necessary functionalities. Some pharmacies may require advanced reporting and analytics tools, while others may prioritize inventory management or CRM capabilities.

Integration capabilities are also important to consider. A pharmacy POS system should be able to integrate with other systems, such as e-prescribing platforms, medication synchronization tools, and wholesalers, to ensure seamless workflow and inventory management.

Factors to Consider When Choosing a Pharmacy Point-of-Sale System

When choosing a pharmacy POS system, there are several factors to consider:

1. Scalability: The system should be able to accommodate the growing needs of the pharmacy, whether it is expanding to multiple locations or increasing its customer base.

2. Ease of Use: The system should have a user-friendly interface and intuitive navigation to ensure smooth adoption and minimal training requirements.

3. Customer Support: The vendor should provide reliable customer support to address any issues or questions that may arise during the implementation and ongoing use of the system.

4. Security and Compliance: The system should comply with industry regulations, such as HIPAA, to ensure the security and privacy of patient information.

5. Customization: The system should allow for customization to meet the specific needs of the pharmacy, such as branding, workflows, and reporting requirements.

Implementing a Pharmacy Point-of-Sale System: Best Practices and Challenges

Implementing a pharmacy POS system requires careful planning and execution. Here are some best practices to consider:

1. Define Goals and Objectives: Clearly define the goals and objectives of implementing a pharmacy POS system. This will help guide the selection and implementation process.

2. Involve Key Stakeholders: Involve key stakeholders, such as pharmacists, technicians, and front-end staff, in the decision-making process. Their input and feedback will be valuable in selecting the right system and ensuring successful implementation.

3. Plan for Training and Support: Allocate sufficient time and resources for training and support. The vendor should provide comprehensive training materials and ongoing support to ensure a smooth transition.

4. Test and Validate: Before fully implementing the system, conduct thorough testing and validation to identify any issues or gaps in functionality. This will help address any issues before they impact daily operations.

5. Monitor and Evaluate: Continuously monitor and evaluate the performance of the pharmacy POS system. Regularly review reports and analytics to identify areas for improvement and make necessary adjustments.

Enhancing Pharmacy Operations with Point-of-Sale Systems: Inventory Management and Reporting

One of the key benefits of pharmacy POS systems is their ability to enhance inventory management and reporting. With a pharmacy POS system, pharmacies can track stock levels, generate purchase orders, and receive real-time updates on inventory status. This helps prevent stockouts and overstocking, leading to improved efficiency and cost savings.

Pharmacy POS systems also provide comprehensive reporting and analytics capabilities. They can generate sales reports, track profitability, and identify trends to make informed business decisions. This data can help pharmacies optimize their product offerings, identify opportunities for growth, and improve overall performance.

Security and Compliance Considerations for Pharmacy Point-of-Sale Systems

Security and compliance are critical considerations when implementing a pharmacy POS system. Pharmacies handle sensitive patient information, and it is essential to ensure the security and privacy of this data. A pharmacy POS system should comply with industry regulations, such as HIPAA, to protect patient information from unauthorized access or breaches.

Pharmacy POS systems should also have robust security measures in place, such as encryption, user authentication, and audit trails. Regular security updates and patches should be provided by the vendor to address any vulnerabilities and ensure the system’s integrity.

Customer Support and Training for Pharmacy Point-of-Sale Systems

Customer support and training are crucial aspects of implementing and using a pharmacy POS system. The vendor should provide comprehensive training materials, including user manuals, video tutorials, and webinars, to help pharmacy staff learn how to use the system effectively.

In addition to training, the vendor should offer reliable customer support to address any issues or questions that may arise during the implementation and ongoing use of the system. This can be in the form of phone support, email support, or a dedicated support portal.

Frequently Asked Questions (FAQs)

Q1. What is a pharmacy point-of-sale system?

A pharmacy point-of-sale system is a software solution that helps manage various aspects of a pharmacy’s operations, including sales, inventory management, customer service, and reporting.

Q2. What are the key features of a pharmacy point-of-sale system?

Key features of a pharmacy point-of-sale system include prescription management, inventory management, sales and payment processing, customer relationship management (CRM), and reporting and analytics.

Q3. How can a pharmacy point-of-sale system benefit a pharmacy?

A pharmacy point-of-sale system can benefit a pharmacy by streamlining operations, reducing errors, improving customer service, increasing efficiency, and boosting profitability.

Q4. How much does a pharmacy point-of-sale system cost?

The cost of a pharmacy point-of-sale system can vary depending on the vendor and the specific features included. It is important to evaluate the pricing structure, including any additional fees for support or updates.

Q5. What factors should be considered when choosing a pharmacy point-of-sale system?

Factors to consider when choosing a pharmacy point-of-sale system include scalability, ease of use, customer support, security and compliance, and customization options.

Conclusion

Pharmacy point-of-sale systems play a crucial role in streamlining operations, improving efficiency, and enhancing customer service in pharmacies. With features like prescription management, inventory control, sales and payment processing, and CRM, these systems offer a comprehensive solution for managing various aspects of a pharmacy’s operations.

By carefully considering factors like pricing, features, integration capabilities, and security, pharmacies can choose the right system that meets their specific needs. Implementing a pharmacy point-of-sale system requires careful planning, training, and ongoing support. However, the benefits of improved efficiency, cost savings, and enhanced customer service make it a worthwhile investment for pharmacies looking to stay competitive in today’s rapidly evolving healthcare landscape.