The Cost of Goods Sold (COGS) is a crucial financial metric that measures the direct costs incurred in producing or acquiring the goods sold by a company. It is an essential component of the income statement and is subtracted from the revenue to determine the gross profit. Understanding COGS is vital for businesses as it helps in evaluating profitability, setting prices, and making informed financial decisions.

COGS represents the expenses directly associated with the production or acquisition of goods. These expenses include the cost of raw materials, direct labor, and any other costs directly attributable to the production process. Cost of Goods Sold (COGS) does not include indirect costs such as overhead expenses, marketing expenses, or administrative costs.

Understanding the Components of COGS

To comprehend COGS fully, it is essential to understand its components. The primary components of Cost of Goods Sold (COGS) include the cost of raw materials, direct labor, and manufacturing overhead.

The cost of raw materials refers to the expenses incurred in purchasing the materials used in the production process. This includes the cost of purchasing the raw materials, transportation costs, and any other costs directly associated with acquiring the materials.

Direct labor costs are the wages paid to employees directly involved in the production process. This includes the salaries of assembly line workers, machine operators, and other employees directly responsible for manufacturing the goods.

Manufacturing overhead costs are indirect costs associated with the production process. These costs include rent for the manufacturing facility, utilities, depreciation of machinery, and other expenses that cannot be directly attributed to a specific product.

Calculating Cost of Goods Sold (COGS): Methods and Formulas

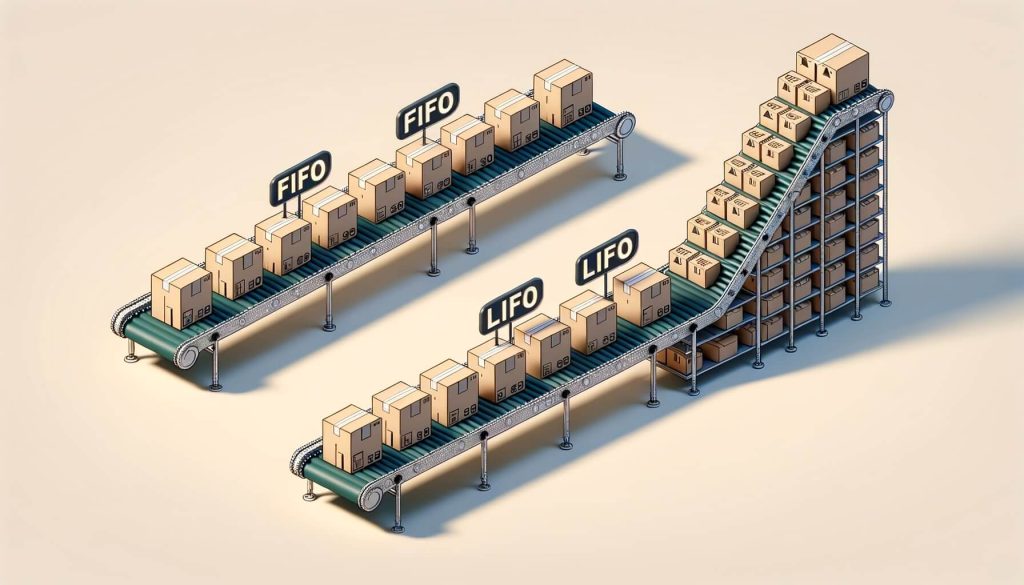

There are several methods and formulas used to calculate Cost of Goods Sold (COGS), depending on the nature of the business and the inventory system employed. The most commonly used methods include the specific identification method, the first-in, first-out (FIFO) method, and the weighted average method.

The specific identification method involves tracking the cost of each individual item sold. This method is typically used for businesses with unique or high-value items, such as art galleries or antique stores. However, it can be time-consuming and impractical for businesses with a large number of inventory items.

The FIFO method assumes that the first items purchased are the first ones sold. Under this method, the cost of the oldest inventory is assigned to the goods sold, while the cost of the most recent inventory is assigned to the ending inventory. This method is widely used and provides a reasonable approximation of the cost of goods sold.

The weighted average method calculates the average cost of all inventory items and assigns this average cost to the goods sold. This method is suitable for businesses with a large number of inventory items and provides a more accurate representation of the cost of goods sold.

Importance of Accurate COGS Calculation

Accurate calculation of Cost of Goods Sold (COGS) is crucial for several reasons. Firstly, it helps in determining the gross profit, which is a key indicator of a company’s profitability. By subtracting COGS from the revenue, businesses can assess how efficiently they are utilizing their resources and generating profits.

Secondly, accurate COGS calculation is essential for setting prices. By understanding the direct costs associated with producing or acquiring goods, businesses can determine the appropriate pricing strategy to ensure profitability. Setting prices too low may result in losses, while setting prices too high may lead to reduced sales and customer dissatisfaction.

Furthermore, accurate Cost of Goods Sold (COGS) calculation is vital for making informed financial decisions. It provides insights into the cost structure of a business and helps in identifying areas where costs can be reduced or efficiencies can be improved. This information is invaluable for budgeting, forecasting, and strategic planning.

Factors Affecting COGS

Several factors can influence the calculation of Cost of Goods Sold (COGS). These factors include changes in the cost of raw materials, fluctuations in labor costs, variations in manufacturing overhead expenses, and changes in inventory valuation methods.

The cost of raw materials is a significant factor affecting COGS. Fluctuations in the prices of raw materials can directly impact the cost of goods sold. For example, if the cost of steel increases, a manufacturing company that uses steel as a raw material will experience higher Cost of Goods Sold (COGS).

Labor costs also play a crucial role in COGS calculation. Changes in wages or the number of employees can affect the direct labor component of COGS. For instance, if a company experiences a labor strike or has to hire temporary workers, it may result in higher labor costs and, consequently, higher COGS.

Manufacturing overhead expenses can also impact COGS. Changes in rent, utilities, or other overhead costs can influence the overall cost of production and, consequently, the COGS.

Additionally, changes in inventory valuation methods can affect Cost of Goods Sold (COGS). Different inventory valuation methods, such as FIFO or weighted average, can result in different COGS calculations. Therefore, businesses need to carefully consider the inventory valuation method they use and its impact on Cost of Goods Sold.

COGS vs. Operating Expenses: Key Differences

It is essential to differentiate between Cost of Goods Sold and operating expenses as they represent different types of costs incurred by a business. COGS refers to the direct costs associated with producing or acquiring goods, while operating expenses include all other costs necessary to run a business.

Cost of Goods Sold is directly related to the production process and includes expenses such as raw materials, direct labor, and manufacturing overhead. These costs are directly attributable to the goods sold and are necessary for generating revenue.

On the other hand, operating expenses include costs such as rent, utilities, salaries of administrative staff, marketing expenses, and other costs not directly associated with the production process. These expenses are necessary for the day-to-day operations of a business but are not directly tied to the production or acquisition of goods.

Analyzing COGS for Financial Decision Making

Analyzing COGS is crucial for making informed financial decisions. By understanding the cost structure of a business and the factors influencing Cost of Goods Sold, businesses can identify areas for cost reduction, efficiency improvement, and pricing optimization.

One way to analyze COGS is by conducting a cost-volume-profit (CVP) analysis. CVP analysis helps in understanding the relationship between costs, volume, and profit. By analyzing the impact of changes in volume or costs on the profitability of a business, managers can make informed decisions regarding pricing, production levels, and cost control measures.

Another way to analyze COGS is by conducting a variance analysis. Variance analysis compares the actual COGS with the budgeted or standard Cost of Goods Sold to identify any significant deviations. By analyzing these variances, businesses can identify the reasons for cost overruns or cost savings and take appropriate actions to address them.

Furthermore, businesses can analyze Cost of Goods Sold by benchmarking against industry standards or competitors. By comparing their COGS with industry averages or competitors’ COGS, businesses can identify areas where they are over-spending or under-performing and take corrective measures.

Common Challenges in Cost of Goods Sold Management

Managing Cost of Goods Sold can be challenging for businesses, especially those with complex production processes or a large number of inventory items. Some common challenges in COGS management include accurate inventory tracking, cost allocation, and changes in cost structure.

Accurate inventory tracking is crucial for calculating Cost of Goods Sold correctly. Businesses need to have robust inventory management systems in place to track the movement of inventory, record purchases and sales, and ensure accurate valuation of inventory. Failure to accurately track inventory can result in incorrect COGS calculations and financial misstatements.

Cost allocation is another challenge in COGS management, especially for businesses with shared resources or joint production processes. Allocating costs accurately to specific products or inventory items can be complex and requires careful analysis and judgment. Incorrect cost allocation can lead to distorted Cost of Goods Sold calculations and inaccurate profitability analysis.

Changes in the cost structure can also pose challenges in COGS management. Fluctuations in the prices of raw materials, labor costs, or manufacturing overhead expenses can impact the overall cost of production and, consequently, the COGS. Businesses need to closely monitor these changes and adjust their COGS calculations accordingly.

Frequently Asked Questions (FAQs) about COGS

Q1. What is the difference between COGS and operating expenses?

COGS refers to the direct costs associated with producing or acquiring goods, while operating expenses include all other costs necessary to run a business.

Q2. How is COGS calculated?

COGS can be calculated using various methods, including specific identification, FIFO, and weighted average. The method used depends on the nature of the business and the inventory system employed.

Q3. Why is accurate COGS calculation important?

Accurate COGS calculation is important for evaluating profitability, setting prices, and making informed financial decisions. It provides insights into the cost structure of a business and helps in identifying areas for cost reduction and efficiency improvement.

Q4. What factors can affect COGS?

Factors that can affect COGS include changes in the cost of raw materials, fluctuations in labor costs, variations in manufacturing overhead expenses, and changes in inventory valuation methods.

Q5. How can businesses analyze COGS for financial decision making?

Businesses can analyze COGS through cost-volume-profit analysis, variance analysis, and benchmarking against industry standards or competitors. These analyses help in understanding the relationship between costs, volume, and profit and identifying areas for improvement.

Conclusion

The Cost of Goods Sold (COGS) is a critical financial metric that measures the direct costs associated with producing or acquiring goods. It is essential for evaluating profitability, setting prices, and making informed financial decisions.

Understanding the components of COGS, calculating it accurately, and analyzing it for financial decision making are crucial for businesses. Factors such as changes in raw material costs, labor costs, manufacturing overhead expenses, and inventory valuation methods can affect COGS.

Businesses face challenges in managing COGS, including accurate inventory tracking, cost allocation, and changes in cost structure. By addressing these challenges and leveraging COGS analysis, businesses can optimize their cost structure, improve profitability, and make informed financial decisions.