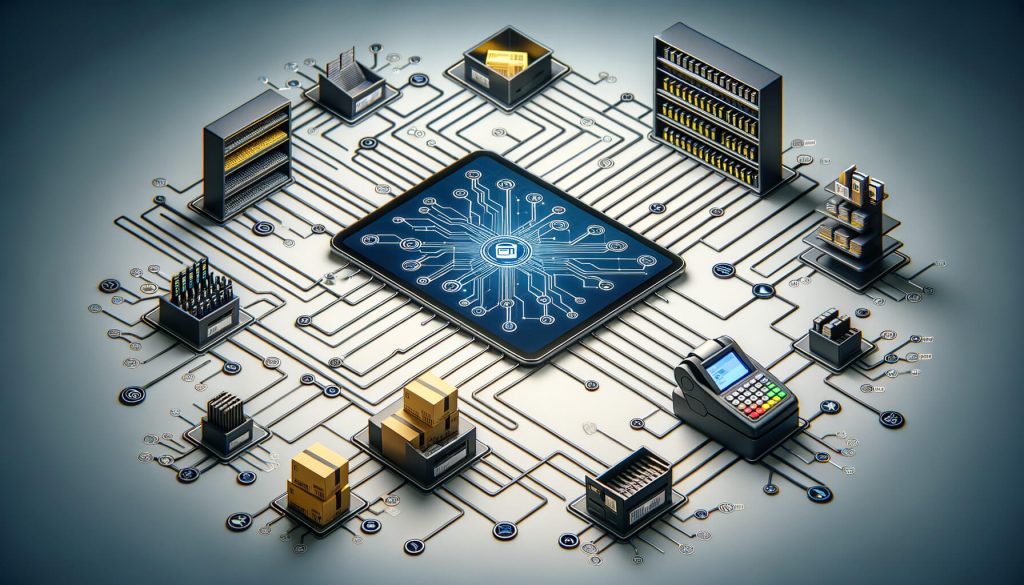

In today’s fast-paced and competitive bar industry, having an efficient and reliable point of sale (POS) system is crucial for success. A POS system is not just a cash register; it is a comprehensive tool that helps streamline operations, improve customer service, and increase profitability. From processing transactions to managing inventory and tracking sales, a well-chosen POS system can revolutionize the way your bar operates.

In this article, we will explore the factors to consider when choosing a POS system for your bar, assess your bar’s specific needs and requirements, understand the different types of POS systems available, and evaluate key features, user interface, integrations, pricing, security, and customer support options.

Factors to Consider When Choosing a POS System for Your Bar

When selecting a POS system for your bar, it is essential to consider several factors to ensure that you choose the right system that meets your specific needs. Here are some key factors to consider:

- Scalability: As your bar grows, you need a POS system that can scale with your business. Look for a system that can handle increased transaction volumes, additional terminals, and new features as your bar expands.

- Ease of Use: A user-friendly interface is crucial for your staff to quickly learn and navigate the POS system. Look for a system that offers intuitive design and easy-to-use features to minimize training time and maximize efficiency.

- Integration Capabilities: Your POS system should seamlessly integrate with other bar management tools such as inventory management, reservation systems, and loyalty programs. This integration ensures smooth operations and eliminates the need for manual data entry.

- Reporting and Analytics: A robust reporting and analytics feature is essential for tracking sales, inventory, and customer behavior. Look for a POS system that provides detailed reports and real-time insights to help you make informed business decisions.

- Mobility: In today’s mobile-driven world, having a POS system that supports mobile devices can be a game-changer. Mobile POS systems allow your staff to take orders and process payments directly at the table, improving efficiency and enhancing the customer experience.

- Customization Options: Every bar has unique needs and requirements. Look for a POS system that offers customization options, allowing you to tailor the system to your specific workflows and preferences.

- Cost: While cost is an important consideration, it should not be the sole determining factor. Consider the value and return on investment (ROI) that the POS system can provide in terms of increased efficiency, reduced errors, and improved customer service.

Assessing Your Bar’s Specific Needs and Requirements

Before diving into the vast array of POS systems available, it is crucial to assess your bar’s specific needs and requirements. Understanding your business processes, goals, and pain points will help you narrow down your options and choose a POS system that aligns with your unique needs. Here are some questions to consider:

- What are your primary goals for implementing a POS system? Are you looking to improve efficiency, reduce errors, increase sales, or enhance the customer experience?

- What are your current pain points and challenges? Are you struggling with inventory management, order accuracy, or slow transaction times?

- How many terminals do you need? Consider the number of cash registers or order stations required to handle your peak business hours.

- Do you have any specific requirements for integrations with other bar management tools? For example, do you need the POS system to integrate with your inventory management software or loyalty program?

- What is your budget for a POS system? Consider both upfront costs and ongoing fees, such as software licensing, hardware maintenance, and support.

Understanding the Different Types of POS Systems Available

POS systems come in various types, each offering different features and functionalities. Understanding the different types will help you choose the one that best suits your bar’s needs. Here are the three main types of POS systems available:

- Traditional On-Premise POS Systems: These systems require a dedicated server and are installed on-site. They offer robust features and customization options but require significant upfront investment and ongoing maintenance.

- Cloud-Based POS Systems: Cloud-based POS systems are hosted on remote servers and accessed through the internet. They offer flexibility, scalability, and real-time data access from anywhere. These systems are typically subscription-based, with lower upfront costs and automatic software updates.

- Hybrid POS Systems: Hybrid POS systems combine the features of both traditional on-premise and cloud-based systems. They offer the flexibility of cloud-based systems with the added security and reliability of on-premise servers.

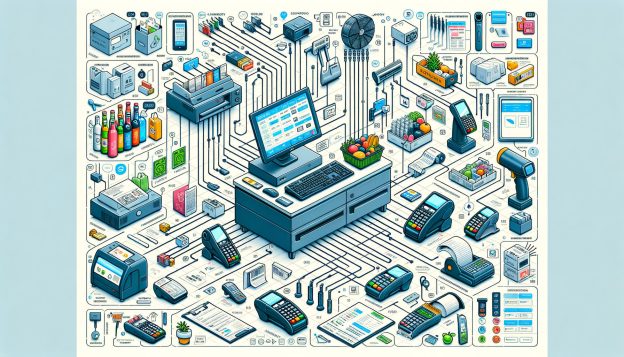

Key Features to Look for in a Bar POS System

When evaluating different POS systems for your bar, it is essential to consider the key features that will enhance your operations and improve customer service. Here are some key features to look for:

- Order Management: A robust order management feature allows your staff to take orders quickly and accurately. Look for a system that supports modifiers, split checks, and table mapping to streamline the ordering process.

- Inventory Management: Efficient inventory management is crucial for controlling costs and reducing waste. Look for a POS system that offers real-time inventory tracking, automated reordering, and ingredient-level tracking for specialty cocktails.

- Employee Management: Managing your staff’s schedules, roles, and permissions is essential for smooth operations. Look for a POS system that offers employee management features such as time clock integration, shift scheduling, and performance tracking.

- Customer Relationship Management (CRM): Building strong customer relationships is vital for repeat business. Look for a POS system that offers CRM features such as customer profiles, loyalty programs, and targeted marketing campaigns.

- Payment Processing: Seamless and secure payment processing is a must-have feature for any POS system. Look for a system that supports various payment methods, including credit cards, mobile payments, and gift cards.

- Reporting and Analytics: Detailed reports and analytics provide valuable insights into your bar’s performance. Look for a POS system that offers customizable reports, real-time data, and integration with analytics tools for in-depth analysis.

- Online Ordering and Delivery: In today’s digital age, offering online ordering and delivery options can significantly boost your sales. Look for a POS system that integrates with online ordering platforms and offers delivery management features.

Evaluating the User Interface and Ease of Use

A user-friendly interface is crucial for your staff to quickly learn and navigate the POS system. Complicated and clunky interfaces can lead to errors, slower service, and frustrated employees. When evaluating a POS system, consider the following factors related to user interface and ease of use:

- Intuitive Design: Look for a POS system with a clean and intuitive design that minimizes the learning curve for your staff. The system should have a logical flow and easily accessible features.

- Touchscreen Compatibility: Touchscreen interfaces are becoming increasingly popular in the bar industry. Ensure that the POS system supports touchscreen devices for seamless order entry and navigation.

- Customizable Layout: A customizable layout allows you to tailor the POS system to your specific workflows and preferences. Look for a system that allows you to rearrange buttons, create shortcuts, and personalize the interface.

- Training and Support: A POS system is only as good as the training and support provided by the vendor. Look for a vendor that offers comprehensive training materials, on-site training sessions, and responsive customer support to ensure a smooth transition and ongoing assistance.

Integrations and Compatibility with Other Bar Management Tools

A POS system should seamlessly integrate with other bar management tools to streamline operations and eliminate manual data entry. When evaluating a POS system, consider the following factors related to integrations and compatibility:

- Inventory Management Integration: Inventory management is a critical aspect of bar operations. Look for a POS system that integrates with your preferred inventory management software to automate inventory tracking, reordering, and ingredient-level tracking.

- Reservation System Integration: If your bar accepts reservations, look for a POS system that integrates with your reservation system. This integration allows for seamless communication between the POS system and the reservation system, ensuring accurate table assignments and order management.

- Loyalty Program Integration: A loyalty program can help drive repeat business and increase customer loyalty. Look for a POS system that integrates with your loyalty program software to automatically track and reward customer purchases.

- Online Ordering Platform Integration: If you offer online ordering, look for a POS system that integrates with popular online ordering platforms. This integration ensures that orders placed online are seamlessly integrated into your POS system for efficient order processing.

Pricing and Cost Considerations for a Bar POS System

Pricing is an important consideration when choosing a POS system for your bar. While cost should not be the sole determining factor, it is essential to understand the pricing structure and consider the long-term costs associated with the system. Here are some pricing and cost considerations to keep in mind:

- Upfront Costs: Traditional on-premise POS systems often require significant upfront investment in hardware, software licenses, and installation. Cloud-based POS systems typically have lower upfront costs as they are subscription-based.

- Ongoing Fees: Consider the ongoing fees associated with the POS system, such as software licensing, hardware maintenance, and support. Cloud-based systems often have monthly or annual subscription fees, while on-premise systems may require periodic software updates and maintenance.

- Scalability: Consider the scalability of the POS system and how it aligns with your bar’s growth plans. Some systems may charge additional fees for adding terminals or accessing advanced features, while others offer unlimited scalability at a fixed cost.

- Return on Investment (ROI): Look beyond the upfront costs and consider the value and ROI that the POS system can provide. Evaluate how the system can improve efficiency, reduce errors, increase sales, and enhance the customer experience to determine the long-term benefits.

Security and Data Protection Measures

Security and data protection are paramount when it comes to choosing a POS system for your bar. With the increasing prevalence of data breaches and cyber threats, it is crucial to select a system that prioritizes security. Consider the following security and data protection measures:

- Payment Card Industry Data Security Standard (PCI DSS) Compliance: Ensure that the POS system is PCI DSS compliant, which means it meets the security standards set by the payment card industry. Compliance with these standards ensures that customer payment data is securely processed and stored.

- Encryption: Look for a POS system that uses encryption to protect sensitive data, such as credit card information. Encryption ensures that data is securely transmitted and stored, reducing the risk of unauthorized access.

- User Access Controls: User access controls allow you to define roles and permissions for your staff, ensuring that only authorized personnel can access sensitive data and perform certain functions within the POS system.

- Data Backups: Regular data backups are essential to protect against data loss due to hardware failure, theft, or other unforeseen events. Look for a POS system that offers automatic data backups and secure storage options.

- System Updates and Patches: Regular system updates and patches are crucial for addressing security vulnerabilities and ensuring that your POS system is up to date with the latest security features.

Customer Support and Training Options for Your Bar POS System

Choosing a POS system is not just about the features and functionality; it is also about the support and training provided by the vendor. A POS system is a critical tool for your bar’s operations, and having responsive customer support and comprehensive training options is essential. Consider the following factors related to customer support and training:

- Training Materials: Look for a vendor that provides comprehensive training materials, such as user manuals, video tutorials, and knowledge bases. These resources should be easily accessible and cover all aspects of using the POS system.

- On-Site Training: On-site training sessions can be invaluable for ensuring a smooth transition to the new POS system. Look for a vendor that offers on-site training options tailored to your bar’s specific needs and workflows.

- Responsive Customer Support: A responsive customer support team is crucial for addressing any issues or questions that may arise during the implementation and ongoing use of the POS system. Look for a vendor that offers multiple support channels, such as phone, email, and live chat, with prompt response times.

- Service Level Agreements (SLAs): Service level agreements outline the vendor’s commitment to providing timely support and resolving issues within a specified timeframe. Look for a vendor that offers SLAs to ensure that your support requests are prioritized and resolved promptly.

FAQs

Q1. How much does a POS system for a bar cost?

The cost of a POS system for a bar can vary depending on factors such as the type of system, the number of terminals, and the features included. Traditional on-premise systems can range from several thousand dollars to tens of thousands of dollars, while cloud-based systems typically have monthly or annual subscription fees.

Q2. Can a POS system help with inventory management?

Yes, a POS system can significantly improve inventory management for your bar. Look for a system that offers real-time inventory tracking, automated reordering, and ingredient-level tracking for specialty cocktails.

Q3. Can a POS system integrate with my reservation system?

Yes, many POS systems offer integration with reservation systems. This integration allows for seamless communication between the POS system and the reservation system, ensuring accurate table assignments and order management.

Q4. How can a POS system enhance the customer experience?

A POS system can enhance the customer experience in several ways. Features such as mobile ordering, tableside ordering, and loyalty programs can improve convenience and personalization, while accurate order management and quick payment processing can reduce wait times and improve overall satisfaction.

Q5. Is it necessary to choose a PCI DSS compliant POS system?

Yes, it is crucial to choose a PCI DSS compliant POS system to ensure the security of customer payment data. Compliance with these standards ensures that customer payment data is securely processed and stored.

Conclusion

Choosing the right POS system for your bar is a decision that can significantly impact your operations, customer service, and profitability. By considering factors such as scalability, ease of use, integrations, key features, user interface, pricing, security, and customer support, you can make an informed decision that aligns with your bar’s specific needs and requirements.

Remember to assess your bar’s goals and pain points, understand the different types of POS systems available, and evaluate the features and functionalities that will enhance your operations and improve the customer experience. With the right POS system in place, you can streamline your bar’s operations, increase efficiency, and ultimately drive success in the competitive bar industry.